To identify the problems of insufficient reproduction or identifying factors ...

Thus, this line reflects these payments, taken into account on the debate of cost accounts 20, 23, (25, 26), 29, 44 in correspondence with the relevant subaccounts of account loan 76, 69 (for the totality of all possible correspondence of accounts from this group). From the line 646 on line 647 there are mandatory insurance payments for insurance against industrial accidents and occupational diseases.

48. On line 648, accrued voluntary insurance payments are shown, produced in accordance with the legislation of the Russian Federation and the production costs taken into account: the insurance of property used in the implementation of activities aimed at obtaining income; liability insurance for harm; risk insurance; Contracts of non-state pension provision in favor of employees, as well as other types of voluntary insurance, manufactured in accordance with the legislation of the Russian Federation.

For this line, voluntary medical and other insurance payments are not reflected, carried out by profits and other target revenues of the organization.

Thus, this line reflects the specified payments, taken into account on the debate of cost accounts 20, 23, (25, 26), 29, 44 in correspondence with the relevant subaccounts of the account of account 76 (for the totality of all possible correspondence of accounts from this group).

49. Line 649 shows the accrued representative expenses of the organization for receiving and servicing representatives of other organizations and institutions (including foreign) who arrived for negotiations to establish and maintain mutual cooperation, as well as participants who arrived at the meeting of the Board of Directors (Management Board) and members of the Audit Commissions of the organization; expenses related to the conduct of official reception (breakfast, dinner, dinner or other similar event) representatives; Boftle service of persons participating in a meeting during negotiations, their transport support, visiting cultural and entertainment activities, a cultural program, the payment of services of translators who are not consisting in the state of the organization, that is, expenses taken into account on the debit of accounts 20, 23, (25, 26), 29, 44 in correspondence with credit account 71.

50. The line 650 takes into account the costs of office business trips related to industrial activities: daily, lifting and field allowances, costs for designing and issuing visas, passports, invitations and other similar documents (except for payment of transportation costs reflected in lines 721, and hotel services sent by specialists, employees, reflected in line 720), that is, the costs taken into account on the debate of cost accounts 20, 23, 25, 26), 29, 44 in correspondence with the account of account 71 (for the totality of all possible correspondence of accounts from this Groups).

51. The line 651 reflects the amounts of taxes and fees, state duties, payments and other mandatory contributions, accrued in accordance with the established legislation, taken into account in the cost of production, products, works, services (water tax, land tax, tax on mining, transport tax, payments for pollution of the environment, fees for using the objects of the animal world and for the use of water biological resources, payments for maximum permissible emissions, discharges, levels of harmful effects, waste placement limits, state duty for issuing licenses and licenses and Others).

From the row 651 allocated: on line 652 - tax on mining, on line 653 - land tax, line 654 - water tax, on line 655 - transport tax.

This line does not reflect taxes accrued on the basis of the financial performance of the organization (income tax, gambling tax, a single tax on imputed income, a single agricultural tax, tax paid in connection with the use of a simplified taxation system).

This line also does not reflect: insurance premiums in the FFR, FSS, FFOMS, the amount of VAT, excise taxes, customs and export duties, the amount of payments for excess emissions of pollutants into the environment, the amounts of payments paid under the terms of debt restructuring to budget and extrabudgetary funds , as well as the amounts of taxes accrued in the budgets of various levels in the event that such taxes were previously included in the taxpayer in the costs of debiting the taxpayer's payables on these taxes.

Thus, these lines reflect the amounts of taxes and payments, taken into account when accrued on the debit of accounting accounts of costs 20 (23, 25, 26, 29, 44) in correspondence with the loan of the respective accounts of account 68 (for the totality of all possible correspondence of the accounts of this group ).

52. The line 656 reflects the amount of fees under the sale and sale of forest plantations for the volume of wood harvested, taken into account in the cost of the production of goods (works, services), that is, the amount taken into account on the debit of accounting accounts costs 20 (23, 25, 26, 29).

53. Line 657 reflects the costs of paying for work and services of third-party organizations and individual entrepreneurs who are included in the costs of the production of goods, products, works, services in accordance with the procedure established by law (including work and unproductive services), that is, the cost of paid by the organization of works and services performed and supported by third-party organizations and individual entrepreneurs, accountable on the debit of cost accounts 20, 23, (25, 26), 29, 44 in correspondence with the loan of sub-accounts of accounts 60, 76 (for the aggregate of all possible correspondence of accounts from of this group).

This line also reflects the sums of non-reported VAT for the work paid by this company and services performed and supported by third-party organizations. The services of third parties are not reflected in this line, included in the transport and preparation costs, taken into account as part of the purchase value of goods, raw materials, materials, semi-finished products and components.

From the line 657 in Section 7, the costs of paying for certain types of work and services of third-party organizations are allocated.

54. The line 658 shows themselves directly by the organization itself, without the involvement of third-party organizations, the costs associated with the production and sale of products (goods, works, services), but in their nature are not directly related to any of those listed on rows 601 ,,, ,,

No later than 01.04.2019 organizations (except for small businesses, budget organizations, banks, insurance and other financial and credit institutions) should submit to their territorial authority of Rosstat "Basic information on the activities of the Organization for 2018" in form 1-Enterprise. On how to fill out 1-enterprise for statistics, we will tell in our consultation.

Form 1-Enterprise for statistics approved by order Rosstat dated July 27, 2018 No. 461.

Download the form form 1-Enterprise (statistics) in Excel format.

In Form No. 1, the company includes information on the organization as a whole, i.e., on all branches and other structural divisions, regardless of their location (paragraph 2 of the instructions for filling the form).

Form No. 1 - Enterprise consists of 9 sections:

| Section number | Name section |

|---|---|

| 1 | General Information on Legal Facial |

| 2 | Distribution of authorized capital (fund) between shareholders (founders) |

| 3 | Contributions of foreign legal entities and individuals in the authorized capital (fund) on partner countries |

| 4 | Organizational structure of a legal entity in the reporting year |

| 5 | Information about the production and shipment of goods, works and services |

| 6 | Expenses for the production and sale of products (goods, works and services) |

| 7 | Expenses for the payment of certain types of works and services of third-party organizations |

| 8 | Types of economic activity in the reporting year |

| 9 | Information about the head organization and territorial-separate divisions |

For Form 1-Enterprise Instructions for filling in more details approved

What is a form of 1 enterprise

Form 1-Enterprise (Basic information on the activities of the Organization) in the current version approved by order of Rosstat 27.07.2018 No. 461. This regulatory act canceled the power of the order of Rosstat from 21.08.2017 No. 541, which introduced a form in the previous edition into circulation.

Who gives the form 1-enterprise? The report under consideration is sent to Rosstat all legal entities except:

At the same time, if an economic entity is a non-profit organization, the form of a 1-enterprise in statistical authorities should be given only if it produces products or services for sale (physical or legal entities). Organizations in respect of which the bankruptcy procedure is initiated, also surrender to the form - until the current business entities are listed.

The term of delivery - April 1 of the year, coming for the reporting. The proceeds entails a fine under Art. 13.19 Administrative Code of the Russian Federation up to 70 thousand rubles. on a legal entity. But if you do not really be late with the surrender of the report, there is a small chance to avoid a fine (letter of Rosstat dated January 14, 2016 No. 03-03-1 / 1-media).

Information in the form of a 1-enterprise is reflected in the entire legal entity as a whole (both by the head organization and by divisions).

Organizations that did not carry out economic activities during the year are given the form only in part sections 1, 2, 3 and 4.

Consider which in principle there are sections and what are the nuances of filling out the form of statistics 1-Enterprise.

The form of the report in question is presented:

All data, unless otherwise provided by the form structure, is indicated for the reporting year.

Filling form has quite a lot of nuances. Consider them.

When filling out the form 1, the company should be borne in mind that:

Do not know your rights?

Indicators in the form 1 enterprise can be determined based on data on other forms of statistical reporting. Consider them.

So, when filling out the form in question, it should be borne in mind that:

We are talking about data:

If any data in the report 1 enterprise is adjusted, the corresponding changes must be made to other indicated reporting forms in Rosstat, and vice versa (letter of Representative Office of Rosstat in the Perm region of 03/13/2018 No. VP-27-204 / 625) .

Indicators in the form 1-Enterprise must in some cases compared with and with information on accounting reporting. Consider them.

We are talking about such indicators as:

The sum of these values \u200b\u200bshould not differ by more than 5% (in a large or smaller side) from the indicator on line 2110 in column 3 of profit and loss report.

With the discrepancy between the information between statistical and accounting reporting, Rosstat can recognize the first unreliable and finfing the company, as in the case of non-trial reports, under Art. 13.19 Administrative Code.

Note that when comparing data in the form of a 1-enterprise, other reporting forms in Rosstat and accounting reporting should consider all methodologically comparable indicators (permistate letter No. VP-27-204 / 625-DR).

The report can be delivered to Rosstat in paper or electronic form (using the EDS).

We picked up for you excellent electronic reporting services!

Full instructions for filling out the form 1-Enterprise is provided in the order of Rosstat dated January 30, 2018 No. 39.

Report on the form 1-Enterprise passes all legal entities except small enterprises, budgetary organizations, insurance and credit and financial organizations. Indicators for this form are compared with other reports for Rosstat and accounting reporting.

Form 1-Enterprise is a report of federal stand-ups for 2018, which will have to take many companies that have fallen into a special sample of Rosstat. The article presents the procedure for filling this report, as well as a form of a 1-enterprise that can be downloaded.

Statistical reporting form No. 1-enterprise, which is called "Basic Information on the Organization's Activities", approved by order of Rosstat dated July 27, 2018 N 461. Order of Rosstat dated January 30, 2018 N 39 new instructions for filling out the form were put into effect.

The form of federal statistical observation is an annual and contains all the basic information on the activities of Russian enterprises of all forms of ownership and industries. Sometimes the accountants have questions: what is this form 1 enterprise, who gives? Understand these questions is easy. The Rosstat website has a service that allows you to identify respondents all statistical reports. Relinted from the need to take this report to statistics only budget enterprises, banks and credit and financial organizations, as well as insurance companies. Individual entrepreneurs also do not pass.

Form 1 The company for 2018 should be sent to the territorial statistical body no later than April 1, 2020. If the respondent fails with a report, it is wondering. In this regard, it is better not to postpone the direction of the form in Rosstat on the last day, but to do it in advance.

Form 1-Enterprise is updated by the statistical service annually, but actually serious changes in comparison with the reporting of 2017 officials did not contribute to it. Approved by Rosstat Form 1-enterprise for 2018 is supplemented with a special instruction (directions) to fill it. The instruction was introduced by order of Rosstat from 30.01.2018 N 39 and contains all the necessary recommendations for filling out the report. If you follow its instructions, it will not be done to cope with this task.

In addition, Rosstat by its order dated July 29, 2016 N 374 introduced a long list of one-time applications to form N 1. They are divided by activities of organizations.

Form 1 The company for 2018 has changed slightly compared with the 2017 Blank. It still consists of 9 sections. They are divided as follows:

Section 1 is a title report list. It needs to specify general information about the organization. The most voluminous in the form of a 1-enterprise for 2018 are sections 5 and 6, because in the first of these it is necessary to bring data on the activities of the respondent's organization, in particular, on the production and implementation of goods and services. You need to write about the cost of their acquisition in sections 6 and 7 of the document. Separate section 9 is designed to reflect information about the head organization and separate divisions, if such is.

You can fill out as manually and on the computer. Any color ink is allowed, except red and green. All indicators, except for the number of employees, are indicated in thousands of rubles with one decimal sign (a sign after the comma). To begin, fill in Section 1, which fits the name and address of the respondent's company. In addition, it needs to specify the OKPO code of the company.

The section also has fields 101 and 102, where you must specify two dates:

If the Jurlso was not educated in the reporting year, then the fields 103-108 do not need to fill out. Otherwise, they need to specify information about the formation of a legal entity. This can be both a new venture and a company that turned out as a result of reorganization, merging or allocation.

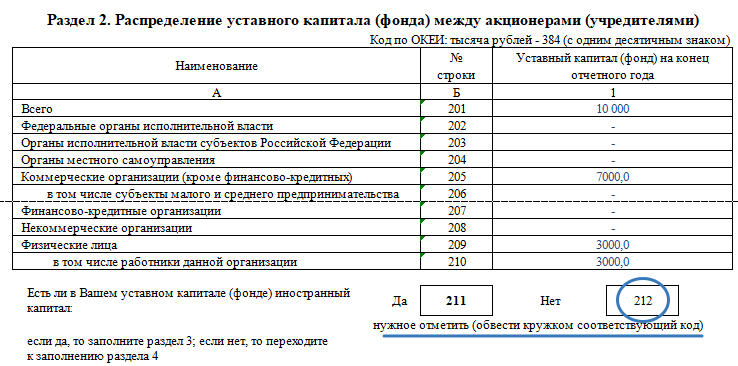

Section 2 forms 1-Enterprise for 2018 indicates data on the authorized capital of a legal entity. It is necessary to specify its size, as well as sources of formation in the fields 202-210, in accordance with existing shares. In order to note the participation or, on the contrary, the non-participation of foreign persons in the formation of authorized capital, one of the fields 211 or 212 should be obliged. If foreign subjects financed the company, you will have to fill in the section 3 of the report. If such a need has nevertheless originated, then in the field 301, the volume of foreign capital in Jurlice is affixed, in the field 302 - the membership or subdition of the participants.

Section 4 is intended for information about the organizational structure of the respondent. In the fields 401 and 402, you need to specify data on the number of separate divisions, including branches and their territorial location.

One of the most voluminous in the document - section 5 - is filled on the basis of accounting and tax accounting. In some way, he duplicates the balance of the enterprise (form 1) for 2018.

In the field 501 you need to enter the sum of the total turnover of the organization during the reporting period. Next, this value is decrypted:

Section 6 of the report is intended for information on the costs of legal entities on the production and sale of goods, services and works, as well as the corresponding indicators. In addition, in this section it is necessary to specify the remains of TMC, both at the end and at the beginning of the reporting period. In the same section, the form reflects all taxes and fees paid in the reporting period to be included in the cost of goods, works and services. For this, strings 651-655 are designed. Separately indicates the amount of VAT accrued for the goods, services and work in 2018, it should be reflected in the form 670 line.

New form "Basic information on the activities of the organization (1-Enterprise)" Officially approved by document Order of Rosstat dated July 27, 2018 N 461 (Ed. from 10.10.2018).

Read more about Application OKD form 0601009:

Forms of federal statistical observation N 1-Enterprise "Basic Information on the Organization's Activities" approved by order of Rosstat ... dated 12/20/2012 N 643 * (1 ..., to fulfill whose organization allocates workers' main activities with the payment of them. . The above, in accounting an organization engaged in the construction of the facility of fixed assets, as they are built ...

Sections: 1 "Income Information"; 2 "Information about expenses"; 3 "Property information"; 4 "Account information in .... If pedagogical or scientific activity was an activity at the main place of work (for example, ... Organizations), information about income received from it should be indicated in the "income on the main ... type of gift certificates (cards) issued by trade enterprises; In the form of loans, loans ... organizations and foundations. The income from the available securities is reflected in the section. 1 "Information about ...

Content. First of all, basic information about the taxpayer (Section 1) is analyzed, based on these data ... Groups of interrelated persons, business organization, functional scheme of the enterprise, the scheme of the process, commodity ... Organization's management was not carried out). The fourth section is an analysis of the indicators of the financial and economic activity of the taxpayer ... (Balance, profit and loss statement, common ...

Before the reorganization, the subsidiary complied with the criteria established by subparagraph 1 of paragraph 3 ... Total property of specialized prosthetic and orthopedic enterprises, including temporarily ... Providing property for rent is the main activity of the taxpayer and is carried out by it ... patents in accordance with sub-clause 1.1 of paragraph 8 of Article 346. ... individual entrepreneurs in the tax authority of information on issued by organizations and individual entrepreneurs physical ...

In case number A47-9881 / 2017). The beginning of this case is usual: ... the taxpayer's income according to the rules of paragraph 1 of Art. 272 Tax Code of the Russian Federation, ... paragraph 1 of Art. 264 of the Tax Code of the Russian Federation as the expenses for the management of the organization; Costs ... Head of 5 organizations; The main type of activity of the Criminal Code - Holding Management Activities; Information on the average number of ... 9 classes, for the remuneration was opened by the company, the Director of the Criminal Code never worked ... Do not contribute to minimizing tax payments. This solution is contained in the review ...

And the environment surrounding them [1]. The above definition of this ... humans and culture, as well as basic information about the listed branches of general environmental science ... Scientific (false scientific) and pseudo-propelled activities, in their motivated facet of fake ... international prizes, high international titles, organizing speeches, tour and "recognition" ... prices of enterprises about "personal responsibility" (irresponsibility) of the main participants in the valuation of the value of enterprises for ...

The period of practice in enterprises, in institutions, organizations whose employees are subject to professional ... medical examination. Notice: The list of medical examinations depends on the scope of the employer's organization. He ... and laboratory research, information about the suffered infectious diseases, mark on the passage of hygienic training ... Fakes can be distinguished by the following basic signs: a medical unit is printed on paper ...) Certification period Note 1 2 3 4 5 6 .. .

...); - 11 (short) "Information about the presence and movement of fixed assets (funds) of non-commercial organizations" (form and ... 11 (brief) "Information on the presence and movement of fixed assets (funds) of non-profit organizations" comparing the form ... (except Small enterprises, including microenterprises) of all types of economic activity, in fact ... not used in the economic activity of the organization. In column 1 indicates the name of the object in ...

Debt liabilities specified in paragraph 1.1 of Article 269 of the Tax Code of the Russian Federation. Under ... Fixed assets are used both in the income-generating activities and in the non-commercial activities of the organization ... shares of a subsidiary organization only after entering into an incorporation information about the liquidation of the organization. Letter from ... -03-06 / 1/40729 Any income received by the Organization within the framework of activities aimed at ... institutions, state and municipal unitary enterprises; The provision of these services is a duty ...

Regulatory regulation of the main legislative acts regulating the labor activity of migrants from other ... other countries, primarily an enterprise (or physical person) necessary ... to make an agreement on the provision of paid medical services with a medical organization, employer Must specify information on permission to work or patent ... which are provided by the administrative responsibility of the employer: 1) if a foreigner is employed without ...

Made during the current production activities of the debtor's organization, recognized under the legislation of the Russian Federation ... (bankruptcy) "(hereinafter - the Bankruptcy Law). According to paragraph 1 of Art. 131 of the law is all ... @, can be invalid. To note: earlier this event FNS administrative ..., services) - in full amount; on fixed assets and intangible assets - in the ... Tax Code of the Russian Federation; The company, being a heat supply organization, provides an adjustable type of activity and devoid of ...

Primary documents contain unreliable information and do not confirm reality ... Documents contain unreliable and controversial information, the taxpayer's counterparties are absent at ... On the applicant's application of the scheme of concealing part of the income from the main type of activity ... Head "; The number of employees was 1 person; Organizations are registered at the "Mass" addresses ... p. Peregutov A.G., Novomichurinskoe enterprise of industrial railway transport) - Contrary to ...

Morally outdated computer equipment) in the organization's activities are not used. How it is right ..., what postures, what documents? The company has fixed assets (hereinafter referred to as OS), depreciation ... The morally obsolete computer equipment) in the activities of the organization are not used. How it is right ... activities (paragraph 30 of Part 1 of Article 12 of the Law on Licensing). Consequently, if in the organization ... accounting of revenues from the sale of fixed assets. To note: for violation of the established rules ...

33N Consider the main amendments in this instruction, which ... Order of the Ministry of Finance of the Russian Federation No. 189n). Information on the results of the activities of the State Execution Institution (... - Code of the Contour of the Identification of information about the object: 1 - information that does not constitute a state secret ... Unitary enterprise 24 Transfer of the object of unfinished construction in a different business entity ... Plots 5 unsatisfactory work of contractors Organizations (for example, violation of the fulfillment time ...

Regulatory legal acts regulating the activities in the field of construction, so ... (reorganization) of existing shops of the enterprise and objects of the main, utility and maintenance destination .... In accordance with paragraph 1.1 of VN 58-88 (p) this ... with the involvement of third-party organizations. Recall that the attraction of a third-party organization should be carried out .... "B" p. 1 h. 1 Art. 95 of the contract of the contract system change ... Information on the timing of the work under the contract and actually information about the object of the main ...